In the midst of an inflationary wave, how can retailers build consumer loyalty while protecting their profitability?

In November 2021, the Financial Times headlined « Ikea warns of price rises and lower profits as cost and supply pressures bite ». This is unprecedented for a retailer whose competitors have been jealous of its price image since its inception. Inflation is the talk of the town, but is it an immediate reality, a future reality or a consumer perception? In any case, all the retailers we met have identified inflation as one of the major challenges for their brand in 2022.

In this article, we will take stock of the situation and analyse the media coverage of inflation, consumer behaviour and its consequences. We will then identify the levers available to retailers to preserve their price image and profitability.

Inflation: national indicators and price increases in FMCG

The currently available inflation data alone do not allow conclusions to be drawn about the purchasing power of households in 2022. There are other, as yet unknown, factors at play – such as wage developments. We can nevertheless guess that in these uncertain times, the adaptability and agility of retailers will be essential to meet the challenges of 2022.

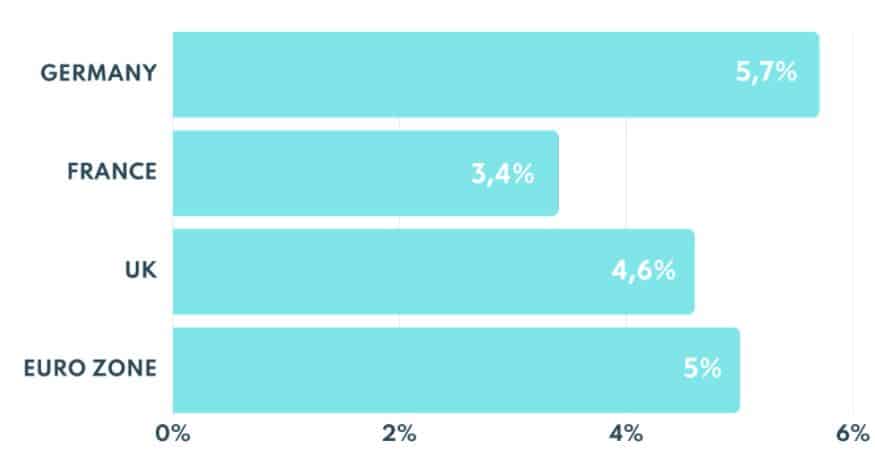

When we look at these figures, inflation is already well underway in 2021:

In Germany, inflation in December was 5.7% over one year (HICP = Harmonised Consumer Price Index), the highest rate since 1993 (Desatis). In France, the HICP is estimated at 3.4% (INSEE) and in the United Kingdom at 4.6% on annual average (Office for National Statistics).

It is clear that increases in energy, transport and raw material costs have had an immediate impact on household purchasing power at the end of 2021. With an average inflation rate of +5%* in the euro zone, this is the highest rate ever recorded (* source: Eurostat).

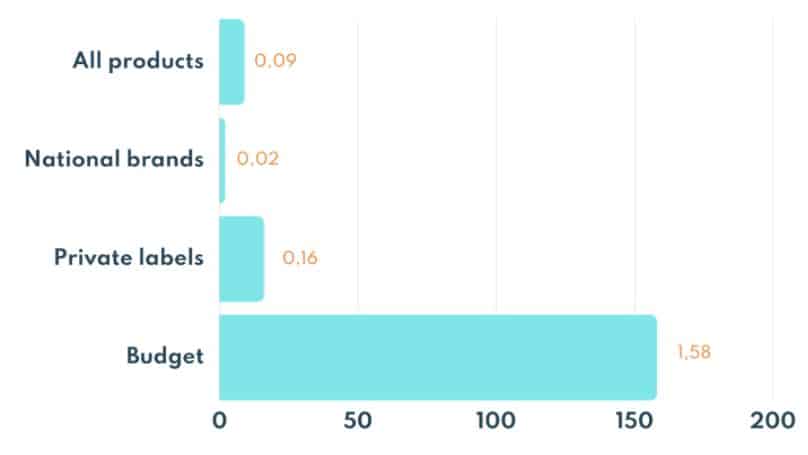

On the other hand, if we analyse the details of consumer goods, inflation is not yet visible on the shelves, but with +0.09% after 20 months of deflation**, this suggests that the beginning of 2022 will be very strongly impacted upwards (**source IRI Visio price).

Data science to the rescue of pricers

Analyzing sales receipts allows pricers to reconstruct key baskets of your price image. In this article, you will find an example of data science analysis to derive marketing intelligence from cash register data. Our users can monitor the evolution of key baskets, and ensure that the most sensitive baskets are spared the price increase campaigns that will be necessary for the retailer. In times of high uncertainty, the retailers we work with ensure that the consumers whose loyalty is most at risk are protected from price increases.

Inflation et price-image

The price image of a retailer is based on a combination of factual elements – price, promotion, etc. – and suggestive communication – shop displays, merchandising, advertising.

The media coverage of inflation plays a key role in determining consumer behaviour. Flooded with media reports and figures, their attention will be focused on the evolution of their average basket and the price of their favourite products. They will start to think about their consumption patterns and the different options available to them.

In the UK, numerous brands have decided to be proactive and communicate on their strategy. Brands seek to protect their image to consumers, to secure their trust, and at the same time inform competitors and suppliers of their desire to fight against inflation. M&S* explains they are making their best not to impact prices on consumers ; Tesco’s CEO Ken Murphy* confesses the struggle:

« There’s no doubt that there are inflationary pressures, (it’s) very hard for us to predict what those are going to look like over the coming months but we’ll do our very best to manage them ».

*Source: Reuters, « UK retailers face inflation hangover after blowout Christmas »

When the spotlight is on price increases for everyday products, the more subtle levers alone are not enough to reassure them. Only a finely executed pricing strategy based on a coherent range structure will offer a concrete response to inflation among consumers and limit the financial losses of retail chains.

Intelligent segmentation and differentiated rules

In specialised distribution, we will pay particular attention to the competitive alignment of open price point products and use impulse buying to recover the price investment that will have been necessary. This differentiated management can be carried out after an intelligent classification upstream of the pricing strategies. An example of automatic classification in cosmetics was presented in a dedicated article that you can find on our blog

Vertical chaining

For all retailers, range consistency remains the keystone of a good pricing strategy as it ensures consumer confidence. Due to the media coverage of inflation, the consumer’s eye is sharpened and will be very sensitive to the consistency of prices that will be visible on the shelf… Don’t forget the basic rules of pricing!

Private labels and first prices are a solution, but not all retailers will be able to use this weapon

When inflation takes hold and retailers are forced to pass on price rises to consumers, the focus is on private labels or first prices. This is what the figures for the end of 2021 show, with first prices up by 1.58% and private labels up by 0.16% after 18 months of constant deflation.

IRI Visio le prix

Private brands and first prices are important margin generators because of the possibility of controlling their production costs. This is a quick adjustment variable to implement. This lever was activated at the end of the year to pass on the soaring costs of certain raw materials, such as pasta with the shortage of durum wheat in September. The price of private brands was immediately adjusted upwards, while the price of national brands remained stable.

With a market share of private labels and first prices at its lowest since 2005***, traditional retailers are facing fierce competition from discounters. While customers used to prefer the private labels of traditional retailers for their price, they are now turning more towards discounters who offer a more complete experience and advocate an increase in the quality of their offer. Discounters in all sectors are reaping the benefits of a price image that is clearly known and understood by consumers. In this period of inflation, they will want to consolidate their positioning, which is an opportunity for them to attract new customers (***source: IRI).

Differentiating private labels offer products that surf on current trends (local / vegan / organic / low carbon footprint / made in France). They will play a key role in the ranges by offering an alternative that is difficult for consumers to compare.

Geo-pricing

When considered only at the national level, the price index analysis can lead a retailer to make a much greater price investment than is necessary to retain customers who are tempted by the competition. Retailers equipped for geopricing position the prices of less sensitive products in a differentiated way in each trading area. This allows them to target price investment in catchment areas where competition is a real alternative for consumers. They can then maximise margins on non-sensitive products in other areas.

Cross-elasticity

Making pricing decisions through the prism of cross-elasticity allows you to test the pricing power of your private labels. Retailers exploiting the full potential of cross-elasticity ensure that their pricing decisions exploit the leverage of private labels to the maximum. In this way, they recover margin without losing attractiveness to consumers who might be tempted by a competing brand. To go further, we invite you to read our article on the place of elasticity in physical retail.

What about national brands?

For several months now, suppliers have been under pressure from price increases in raw materials, transport costs and energy. The best negotiators of 2022 will be known for their ability to find compensation for these price increases at the end of the negotiations.

The range will be profoundly modified: products will be discontinued due to breakage, lack of profitability, or production times will be too long. On the other hand, the range can be extended. This is what our DIY partners have told us, as they wish to ensure product availability for all units of need and to compensate for future shortages. Product availability is a determining factor in the DIY sector where the act of buying is often difficult to postpone. This is illustrated by the disappointments of recent months on building sites due to delays in the delivery of tiles or materials. The range structure will change significantly in width and depth; the price structure will have to follow suit.

Dynamic Segmentation

A pricing strategy based on product attributes automatically adapts to changes in your ranges. The consistency of the range is ensured and does not constitute a laborious task each time a reference is added or removed from the range. An article on this subject will be written soon by Mercio, stay tuned…

Why use promotion in 2022 when the consumer is less sensitive to it?

Promotion is a tool for working on your price image, but it is not easy to implement. It takes time and involves a large number of actors in the store. Analysis tools are often not optimised and can be time-consuming. Also, care must be taken not to drown the consumer in a field of unreadable promotions and to avoid counter-productive actions. For example, promoting a product that is already positioned as the lowest price on the market, increasing the price of a product before implementing the promotion, or implementing a convoluted promotional mechanism in the eyes of the consumer.

But then, why will promotion return in 2022 and help in the fight against inflation? The rise in supplier tariffs is a reality linked to the rise in energy and transport raw materials. But this increase is not permanent. For example, one distributor recently told us that freight costs have increased by an average of five times compared to 2020 but are beginning to stabilise, with the multiplier falling back to 3.5 today. When the situation improves during the year, retailers will not fail to return to negotiations and obtain promotional budgets from their suppliers.

Marketing erosion

The consequences of promotions on the margin must be controlled. Dedicated dashboards allow you to draw intelligence from your checkouts, and to understand the side effects that a promotion can have on the pricing policy of the store. You can analyse marketing erosion and consumer behaviour, to finely monitor performance.

Who will come out on top?

All retail players will need to be agile and quick to adjust their prices, analyse consumer behaviour, control their price image and monitor their economic indicators closely. To achieve all these objectives, Mercio has identified the best practices of the most advanced retailers in the field of pricing:

- identify the elements that make up your price image and devote a specific price policy to them, impervious to inflationary trends

- work on the width and depth of your assortments and ensure a seamless range to meet your consumers’ need for reassurance

- use cross-elasticity to optimise the calibration of your vertical chaining. It will both maximise your margins on your private labels and present them as the best alternatives in the shelf offer.

- make price investments only when necessary, differentiating your prices according to each local context

All these good practices are possible thanks to Mercio. We’ll be happy to continue the discussion with you if it can help your brand to ride the inflationary wave calmly and work on your price image over the long term!

Going further with Mercio:

Mercio’s price optimisation software is the secret weapon for many retailers to meet these challenges. It allows retailers to analyse retailer performance and consumer feedback faster than ever before by aggregating data from multiple sources. Pricing strategies then evolve intelligently in line with market trends. The significant time savings offered by Mercio frees operational staff from time-consuming, low-value tasks. This allows retailers to work on their strategies in depth and to be reactive to new trends in their markets. With a powerful environment that allows users to define pricing rules and run unlimited what-if scenarios in seconds, our customers have the ability to thrive in today’s highly competitive retail market.

Find out more about these performance-enhancing modules in the « Our solutions » section.